- 23 Oct 2023

- By API Magazine

A leading national commentator argues Australia’s seemingly high property prices are a mirage, with the next two years set to deliver rich rewards for local and international real estate investors who take the plunge now.

The head of the company that looks after more Australian landlords than any other accounting firm in the world has argued that despite recent property rises, Australia’s capital cities real estate was still far more affordable than comparable major centres globally.

While the biggest cities Sydney and Melbourne were worthy of buyer attention, it was the smaller state capitals that represented the best investment value for international and local buyers alike.

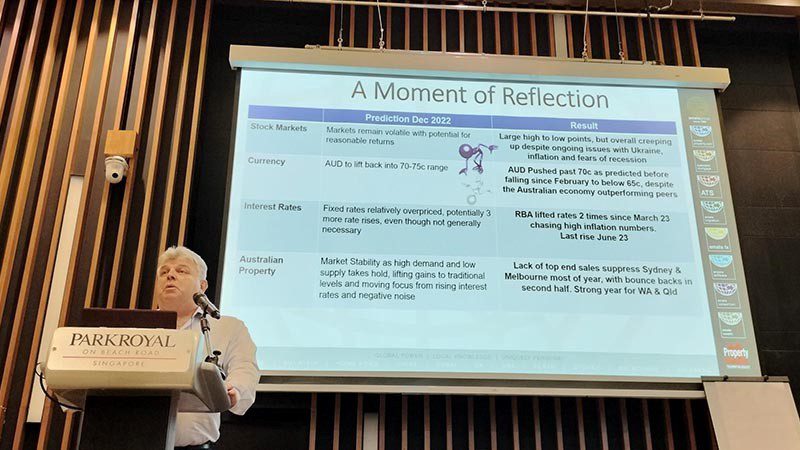

Speaking in Singapore at the aussieproperty.com Annual Market Update Seminar, Steve Douglas, Chairman of SMATS Group and Managing Director of Australasian Taxation Services and aussieproperty.com, said the idea that Australian property was overpriced was very much an Australian perception.

Citing the price of property per square metre around the world, he said it was clear Australian property had the capacity and conditions to continue rising in value.

“Australians are complaining about property prices but if you look at prices internationally it is incredibly cheap by global standards,” he said.

“Buyers in the likes of Hong Kong and Singapore are realising that living in a small apartment as opposed to a large house in Australia is an overwhelmingly attractive proposition.

“Cities like Perth and Adelaide are less than a quarter the price of Hong Kong and around a third of Singapore’s price per square metre.

“Melbourne and Brisbane aren’t far behind, and even Sydney, which does have far higher median dwelling vales than the rest of the country, is a bargain compared to comparable business hubs like New York, Shanghai, Singapore and Hong Kong.”

Mr Douglas agreed with the broader consensus among financial institutions that Australia’s current real estate market recovery had plenty of steam left in it yet.

KPMG’s latest property report on Australia’s capital cities predicted house prices would rise nationally by 4.9 per cent over the next nine months and then surge by 9.4 per cent in the year to June 2025.

Apartment prices across the country were tipped to see an average rise of 3.1 per cent by next June, then a 6 per cent increase in the next 12 months.

But there will be important regional differences, with Perth houses rising the highest – by 8.4 per cent – in the rest of 2024’s financial year (FY) but then Hobart overtaking other cities in FY25 and surging by 14.2 per cent.

Hobart units are also forecast to outperform all other capital cities with rises of 8.7 per cent and 10 per cent respectively over the next two years, followed by Sydney, Melbourne and Adelaide.

Mr Douglas said population growth was the major driver of the national property market.

“I’ve been saying for 30 years that the number one driver of property prices growth is population.

“Three million migrants have come to Australia over the past 11 years and this is one of the key reasons why the country is in fundamentally good economic shape.

“Where this is strategically important is that the quality of migrants is high, comprising young and highly skilled people.

More than half of Australia’s migrant intake is skilled, with the average age being 38.

“Australia doesn’t have to go find tomorrow’s migrants because many of them arrived yesterday as young kids and are now active economic contributors.

“There’s 500,000 of them coming out of university, starting out in the workforce and wanting housing, and that’s on top of the record numbers arriving this year and into the coming years.”

Australian dollar luring overseas buyers

Since January the Australian dollar has slipped from above 71 cents to the US dollar to just 63 cents.

With the exception of a brief but sharp plunge at the onset of Covid, it’s as low as the Aussie has been in ten years and a far cry from the near parity of a decade ago.

But with sound economic fundamentals, Mr Douglas argues the Aussie dollar’s inexplicably low value and the high likelihood it would inevitably rise again, is another major attraction for overseas buyers, particularly from China, who are increasingly turning to Australian property.

“In many countries around Asia, property prices are relatively flat, or like Hong Kong, falling, so Australia’s promise of capital growth is only enhanced when buyers factor in the potential for their Aussie property asset delivering a currency-linked dividend as well.

“Add in interest rates at or near a peak, and I foresee Australian property being in high demand from international and expatriate buyers,” Mr Douglas told the Singapore seminar audience, at which API Magazine was in attendance.

Where should property investors be looking?

National property prices had a 0.8 per cent rise in September as the recovery trend moved through an eighth consecutive month of capital growth.

With the exception of Hobart, every capital city and the nation’s regional property markets all enjoyed strong growth in September.

Adelaide, Brisbane and Perth have been the standout performers over the past quarter but over a year Sydney is up 7.3 per cent and Perth an impressive 8.8 per cent.

Mr Douglas said a case could be made for most of Australia’s capital city property markets.

“If you look at Sydney and Melbourne, there’s 130,000 extra people heading into those population centres and that’s a powerful stimulus for housing demand.

“If you think Aussie property prices are high now, you’ve seen nothing yet; with supply stagnant, prices will rise, mark my words.”

But he saved his biggest praise for the prospects of Brisbane and Perth.

“Brisbane and Perth are going to be the dominant markets for the next couple of years; as much as I love Adelaide it doesn’t have the same population growth but there is limited supply there so I’m satisfied that will also continue to perform almost as well as it has over the past year or so.”

Chronically low vacancy rates around the country are also pushing property prices higher, as renters claw their way into the market to avoid high rents, while investors are returning to markets like Perth’s to capitalise on high rental yields.

National vacancy rates

Source: SQM Research

“I think the property market across the board is going to have a very good 12 months, with Perth probably the standout for investors,” Mr Douglas said.

“There’s a massive, acute undersupply of property and the vacancy rates are nuts!

“I expect plus-five per cent growth and perhaps double-digit growth in Perth and Brisbane.”

The cost pressures on developers were contributing to this lack of supply and price pressure, he said.

“Housing loan commitments are still low, and private residential approvals are still on the decline, why? – because developers are too scared to build because the costs are too high, so if that’s not going to get fixed, where is the supply going to come from?”

“Unless the market is willing to lift the price on new stock by 10, 15, 20 per cent, to allow developers to make decent profits, we are going to have a slow delivery of much-needed stock.”

Article Q&A

Is Australian property expensive compared to the rest of the world?

Speaking in Singapore at the aussieproperty.com Annual Market Update Seminar, Steve Douglas, Chairman of SMATS Group and Managing Director of Australasian Taxation Services and aussieproperty.com, said the idea that Australian property was overpriced was “delusional”. Citing the price of property per square metre around the world, he said it was clear Australian property had the capacity and conditions to continue rising in value.

Where should property investors be looking in 2024?

Speaking in Singapore at the aussieproperty.com Annual Market Update Seminar, Steve Douglas, Chairman of SMATS Group and Managing Director of Australasian Taxation Services and aussieproperty.com, said Brisbane and Perth are going to be the dominant markets for the next couple of years.