- 23 Aug 2024

- By API Magazine

Whether you’re a buyer looking to avoid the most heated competition for property or a seller looking to capitalise on the best conditions to maximise your return, this list and interactive map will shine a light on the areas where sellers are calling the shots.

When listings fall in both the wider region (SA3) and also the suburb, it is usually a sign of a tough market for buyers.

This article identifies 23 suburbs that stand out as having conditions that will remain strongly in favour of sellers over the coming months.

The list has been compiled from data analysis that includes dozens of parameters, including short and long term sales, capital growth, rental affordability, vacancy rates, listings, household income patterns and household sizes and suburban composition of houses compared to units. It also considers the socio-economic standing of suburbs, and median mortgage repayments.

From this vast repository of data has emerged this collection of suburbs where sellers are calling the shots in the real estate market.

Western Australia: market tightness amid strong demand

Mosman Park, Perth – Inner, WA – Units

In Mosman Park, unit listings have seen a slight decrease from 17 to 16, indicating a continuing trend of tightening supply. The median list price has risen to $400,000 from $334,650 a year ago, reflecting strong demand. The rental market remains robust, with the median rent now at $500 per week, up from $395. Inventory has decreased to 1.50 months, with a slight dip in the yield to 7.43 per cent. The low vacancy rate of 2.08 per cent underscores the competitive nature of the rental market, making Mosman Park a desirable area for investors.

Millbridge, Bunbury, WA – Detached houses

Millbridge has experienced a notable drop in listings, with numbers decreasing from 11 to 8 recently. Despite this, the median list price has increased to $593,600, indicating sustained demand. The rental market is strong, with the median lease now at $650 per week, contributing to a healthy yield of 5.41 per cent. The inventory has dropped significantly to 1.94 months, down from 4.68 months three months ago, suggesting that the market is quickly absorbing properties. The vacancy rate is minimal at 1.10 per cent, further highlighting the suburb’s strong rental demand.

Glen Iris, Bunbury, WA – Detached houses

Glen Iris has seen a reduction in listings from 9 to 6 over the past month. The median sale price has risen substantially to $581,830, reflecting increased buyer interest. The rental market remains solid, with the median rent now at $565 per week, yielding 5.59 per cent. Inventory has decreased slightly to 1.57 months, indicating limited supply. The vacancy rate is low at 0.46 per cent, which, combined with strong demand, suggests that both sale and rental markets are likely to continue performing well.

Leschenault, Bunbury, WA – Detached houses

In Leschenault, listings have remained stable at 7 over the past month, with the market showing resilience. The median house price has risen to $841,000, up from $799,000 a year ago, reflecting continued demand. The rental market is steady, with the median rent at $700 per week. Inventory levels are at 1.79 months, down from 2.59 months three months ago, indicating a tightening market. The vacancy rate remains low at 0.56 per cent, and the strong yield of 4.70 per cent suggests that Leschenault continues to attract both buyers and investors.

Kewdale, Perth – South East, WA – Units

Light industrial area Kewdale has seen a significant decrease in unit listings, dropping from 12 to 9 over the past month. The median sale price has increased to $419,000, reflecting the area’s continued demand. Rental prices have also risen, with the median rent now at $550 per week. Inventory has decreased to 1.92 months, down from 2.29 months three months ago, suggesting a competitive market. The vacancy rate remains low at 0.00 per cent, indicating strong rental demand and limited availability, which should continue to support price growth.

Victoria Park, Perth – South East, WA – Units

In Victoria Park, unit listings have decreased from 22 to 20, indicating a tightening market. The median list price remains steady at $408,000, while rental prices have increased, with the median lease now at $530 per week. Inventory has slightly decreased to 1.21 months, with a low vacancy rate of 0.99 per cent. These indicators suggest that demand continues to be strong, with limited supply putting upward pressure on both sales and rental prices.

Carlisle, Perth – South East, WA – Units

Carlisle has experienced a slight decrease in unit listings, from 3 to 2 over the past month. The median sale price has increased to $543,840, indicating strong demand. The rental market remains competitive, with the median rent now at $600 per week. Inventory has decreased to 1.16 months, suggesting a tighter market, while the vacancy rate is low at 0.54 per cent. These factors point to a market where demand continues to exceed supply, likely leading to continued price growth.

Ascot, Perth – South East, WA – Units

Ascot’s unit market has remained stable, with listings unchanged at 5 over the past month. The median sale price has risen to $419,000, reflecting sustained demand. The rental market is also strong, with the median lease now at $585 per week. Inventory has remained stable at 1.33 months, while the vacancy rate is low at 1.34 per cent. These indicators suggest that Ascot’s market is balanced but competitive, with continued potential for price growth.

Bassendean, Perth – North East, WA – Units

Bassendean has seen a sharp drop in unit listings, from 5 to 2, indicating a tightening market. Despite this, the median sale price remains steady at $399,000, while rental prices have increased to $550 per week. Inventory has decreased significantly to 1.05 months, reflecting limited supply. The vacancy rate is low at 0.56 per cent, suggesting strong rental demand. Bassendean’s market conditions suggest that prices may rise further as competition among buyers and renters intensifies.

Morley, Perth – North East, WA – Units

Morley has seen a decrease in unit listings from 7 to 4, highlighting a market with shrinking supply. The median sale price has risen to $520,000, with rental prices also increasing to $550 per week. Inventory has slightly decreased to 1.58 months, indicating a competitive market. The vacancy rate remains low at 0.77 per cent, reflecting strong demand. These factors suggest that Morley’s property market is likely to experience further price growth due to limited supply and high demand.

Analysis Summary:

Across these suburbs in Western Australia, the consistent reduction in property listings signals a tightening market, with demand continuing to outstrip supply. This dynamic is leading to rising prices and strong rental yields, making these areas attractive to both buyers and investors. Low vacancy rates across the board further emphasise the competitive nature of these markets, with limited availability driving both sale and rental prices upward. The short to medium-term outlook for these suburbs remains positive, with continued price growth expected as supply remains constrained.

Queensland: tightening supply and strong demand in Mackay region suburbs

Eimeo, Mackay – Detached houses

Eimeo has seen a substantial reduction in listings for detached houses, with the number of properties for sale dropping from 16 to 10 over the past month. This significant decrease highlights the tightening supply in the market, which is contributing to upward pressure on prices. The median list price has increased to $555,500, up from $463,000 a year ago. The rental market remains robust, with the median rent now at $600 per week, reflecting the ongoing demand for housing in the area. The current inventory is at 2.21 months, up slightly from 1.67 months three months ago, indicating that while supply is limited, the market remains active. The yield stands at 5.67 per cent, with a low vacancy rate of 0.71 per cent, underscoring the strong rental demand in Eimeo.

Sarina, Mackay – Detached houses

Sarina has experienced a notable drop in listings, with the number of available properties decreasing from 20 to 15. Despite the reduction in supply, the median sale price has held steady at $389,000, while the median rent has increased to $500 per week. The inventory level has decreased to 1.98 months, indicating a tight market where demand is likely outpacing supply. With a rental yield of 6.84 per cent and a vacancy rate as low as 0.22 per cent, Sarina continues to be an attractive market for investors, particularly those looking for strong rental returns in a market with limited availability.

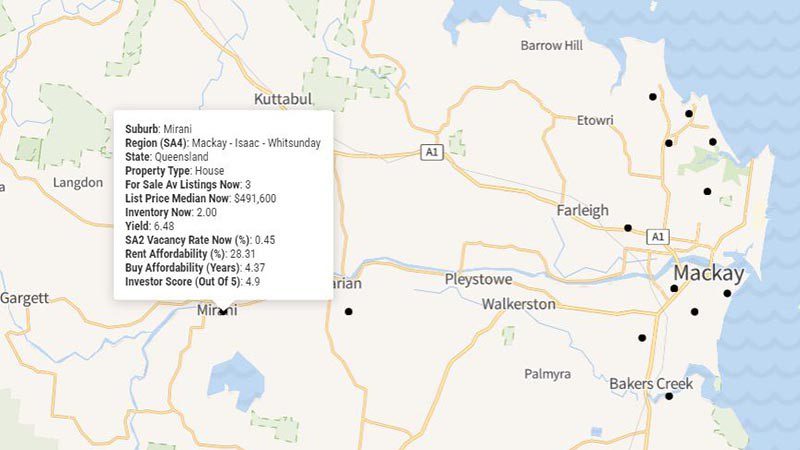

Mirani, Mackay – Detached houses

In Mirani, listings have decreased from 6 to 3 over the past month, reflecting a significant tightening of the market. The median sale price has risen to $491,600, while rental prices have also increased, with the median rent now at $530 per week. Inventory levels are low at 2.00 months, down from 2.74 months three months ago, highlighting the scarcity of available homes. The yield is strong at 6.48 per cent, with a low vacancy rate of 0.45 per cent. This indicates that demand in Mirani is robust, and the limited supply is likely to continue driving up both sales and rental prices.

With a population barely above 4,000, Mackay’s property market is punching above its weight. (Image source: Shutterstock)

Andergrove, Mackay – Detached houses

Andergrove has seen a reduction in listings from 30 to 27 over the past month, signalling a tightening market. The median list price has increased to $485,000, while the rental market remains competitive, with the median rent now at $550 per week. The inventory level has decreased to 1.59 months, reflecting the limited supply. The vacancy rate remains low at 1.27 per cent, indicating strong demand for rental properties. The yield stands at 6.02 per cent, making Andergrove an appealing option for investors looking for solid returns in a market with shrinking supply.

East Mackay, Mackay – Detached houses

East Mackay has experienced a reduction in listings from 15 to 12, further indicating a tightening supply in the market. The median house price has risen to $529,000, with rental prices remaining stable at $530 per week. Inventory levels have increased slightly to 2.25 months, suggesting that the market is competitive but with a slight easing in supply. The vacancy rate remains low at 0.29 per cent, reflecting the strong demand for housing in East Mackay. The yield is healthy at 5.25 per cent, and the continued reduction in listings suggests that prices may continue to rise as competition among buyers remains strong.

Rural View, Mackay – Detached houses

Rural View has seen a decrease in listings from 24 to 21, indicating a tightening market. The median list price has risen to $589,458, up from $514,800 a year ago. Rental prices have also increased, with the median rent now at $625 per week. The inventory level remains low at 1.78 months, reflecting limited supply, while the vacancy rate is minimal at 0.71 per cent. These indicators suggest that demand in Rural View remains strong, and the shrinking supply is likely to lead to continued price appreciation.

Bucasia, Mackay – Detached houses

In Bucasia, listings have decreased from 11 to 9 over the past month, highlighting a reduction in supply. The median house price has increased to $499,000, with rental prices also rising to $580 per week. The inventory level has decreased to 0.80 months, indicating a very tight market. The vacancy rate remains low at 1.17 per cent, and the yield is strong at 6.16 per cent. Bucasia continues to attract buyers and investors, with the limited supply putting upward pressure on prices and rents.

Blacks Beach, Mackay – Detached houses

Blacks Beach has seen a reduction in listings from 12 to 10, reflecting a market with decreasing supply. The median house price has increased to $459,000, while rental prices have risen to $580 per week. The inventory level has decreased to 0.76 months, indicating a tight market where properties are quickly absorbed. The vacancy rate remains low at 0.71 per cent, suggesting that demand is strong and likely to keep driving prices upward. The yield stands at 6.63 per cent, making Blacks Beach an attractive option for investors.

Armstrong Beach, Mackay – Detached houses

Armstrong Beach has experienced a decrease in listings from 6 to 4, indicating a further tightening of the market. The median house price has increased to $500,000, with rental prices rising to $580 per week. The inventory level has decreased to 2.77 months, reflecting a limited supply of properties. The vacancy rate remains low at 0.22 per cent, highlighting strong rental demand. The yield is healthy at 6.85 per cent, and the continued reduction in listings suggests that the market will remain competitive, with prices likely to continue rising.

Glenella, Mackay – Detached houses

Glenella has seen a slight reduction in listings from 13 to 11, indicating a tightening market. The median house price has increased to $620,000, with rental prices rising to $680 per week. The inventory level remains low at 1.73 months, reflecting a limited supply of homes. The vacancy rate is stable at 0.90 per cent, and the yield is strong at 6.02 per cent. These factors suggest that Glenella’s market remains competitive, with continued demand likely to drive further price growth.

Analysis Summary:

The consistent reduction in property listings across these key suburbs in the Mackay region of Queensland reflects a tightening market where demand continues to outstrip supply. This dynamic is leading to rising property prices and strong rental yields, making these areas attractive to both investors and homebuyers. Low vacancy rates and limited inventory suggest that the market will remain competitive, with further price growth expected as supply constraints continue to impact the region.

Victoria: Merbein’s market reflects tightening supply amid strong demand

Merbein, North West Victoria – Detached houses

Merbein has seen a reduction in listings for detached houses, with the number of properties for sale dropping from 8 to 6 in the past month. This decrease in supply, while slight, is indicative of a market where demand continues to outpace available inventory. The median list price currently stands at $290,000, slightly lower than last year’s $310,000, which could reflect a competitive market where properties are moving quickly. Rental prices have remained stable at $350 per week, offering a healthy yield of 5.87 per cent.

The inventory level has decreased to 1.96 months, down from 2.57 months three months ago, highlighting a shrinking supply of available homes. Merbein’s vacancy rate remains at a consistent 0 per cent, indicating no significant surplus in rental properties and reinforcing the area’s strong rental market. Despite the reduced listings, the suburb maintains its appeal to both investors and homebuyers, with its affordability and steady demand likely to continue driving the market forward.

Analysis Summary:

Merbein’s market is characterised by a tightening supply of properties and sustained demand, which is putting upward pressure on prices and maintaining strong rental yields. The reduction in listings is a positive indicator of a healthy market, where homes are in demand, and competition remains robust. This scenario bodes well for both short-term price stability and potential long-term appreciation, making Merbein an attractive location for prospective buyers and investors.

South Australia: supply constraints signal strong market conditions

Burton, Adelaide – North, SA – Detached houses

Burton has experienced a slight reduction in listings for detached houses, with the number of properties for sale decreasing from 9 to 8 over the past month. This minor decrease in supply reflects a tightening market where demand remains robust. The median list price has risen to $604,550, up from $540,000 a year ago, indicating upward pressure on prices. The rental market is equally strong, with the median rent now at $530 per week, up from $490. The current inventory is low at 1.19 months, showing little change from the 1.16 months recorded three months ago, highlighting a continued shortage of available properties. The yield stands at 4.67 per cent, supported by a low vacancy rate of 0.95 per cent, which underscores the sustained demand for housing in Burton.

Berri, South Australia – South East, SA – Detached houses

In Berri, the number of listings for detached houses has seen a more significant drop, from 15 to 12, underscoring a tightening of supply. Despite this, the median list price remains stable at $325,000, a modest increase from $315,000 a year ago. Rental demand is strong, with the median rent at $340 per week, up from $325. Inventory has slightly decreased to 2.50 months, indicating that the market is quickly absorbing properties. The vacancy rate remains low at 0.55 per cent, reflecting the area’s sustained demand. With a rental yield of 5.28 per cent and stable pricing, Berri continues to attract interest from both buyers and investors, particularly in a market where supply is becoming increasingly scarce.

Analysis Summary:

The reduction in listings in both Burton and Berri highlights the tightening of the housing market in these South Australian suburbs. The limited supply is leading to stable or increasing prices, while rental yields remain strong due to high demand and low vacancy rates. These market conditions suggest that both suburbs will continue to see price growth and strong rental returns, making them attractive options for investors and homebuyers alike. The ongoing supply constraints indicate that competition for available properties will likely remain high, further supporting upward pressure on prices.

Article Q&A

Where are the most competitive sellers’ markets in Australian real estate?

This article identifies 23 suburbs that stand out as having conditions that will remain strongly in favour of sellers over the coming months, dominated by Western Australia, Queensland and South Australia. The list has been compiled from data analysis that includes dozens of parameters, including short and long term sales, capital growth, rental affordability, vacancy rates, listings, household income patterns and household sizes and suburban composition of houses compared to units. It also considers the socio-economic standing of suburbs, and median mortgage repayments.