- 14 Feb 2025

- By API Magazine

Australians are increasingly contending with unaffordable real estate slipping from their grasp but on a global scale things aren’t necessarily as bad as they might seem.

With the fifth highest price in the world per square metre, Australian homes are increasingly moving beyond reach of the average Australian.

Housing affordability in Australia is at an historic low, with the proportion of median family income required to service an average loan repayment climbing to 48.6 per cent.

It now requires the entirety of 147 monthly pay packets for the average wage earner in Australia to buy the median priced home, which is now worth $814,000.

While times are definitely tougher for today’s generation of home buyers seeking a slice of the great Australian dream, on a global scale we actually have cause to breathe a sigh of relief.

In a measure of housing affordability in 62 countries around the world, Australia is still a relatively lucky country.

It ranked a favourable 12th in terms of affordability on that measure, according to a major study by UK-based BestBrokers, one place behind New Zealand.

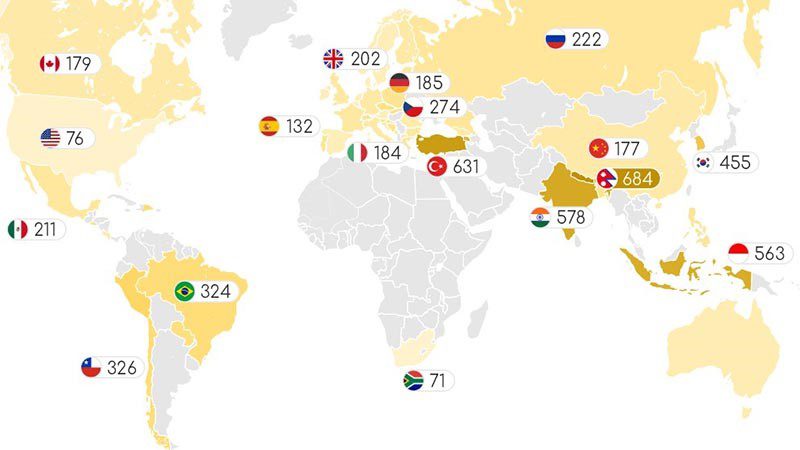

South Africans enjoyed the most affordable property, requiring just 71 net monthly wage payments to buy a home. Although their monthly income was just A$2,165 (compared to Australia’s $6,898), they were only paying $1,456 per square metre for the median priced home, compared to Australia’s comparatively huge $9,847 (The median price of an apartment for sale is $12,477/m². For houses, the median price is $4,505/m²).

Rounding out the top ten were the US (76 monthly salaries), Bahrain (99), Denmark (114), Ireland (123), Sweden (129), Spain and Belgium (132), Cyprus (139) and Norway (140).

At the most expensive end of the spectrum was Nepal, where high prices and low incomes meant it required a debilitating 684 (or 57 years’ worth) of monthly salaries to buy the average home. Turkey (631), India (578) and Indonesia (563) offered almost as little hope to home buyers.

Paul Hoffman, financial expert at BestBrokers, said with inflation slowing down in 2024, central banks in major economies have begun cutting interest rates, yet the cost of mortgages is still discouraging people from purchasing a home.

“Home buyers in some countries benefit from low interest rates on house loans in combination with relatively high average income, whereas in struggling economies, purchasing a home is now nearly impossible for most.”

Many analysts, he said, prefer tracking not only CPI (consumer price index, typically used to express inflation) but also the so-called “real” mortgage interest rates, i.e. mortgage interest rates when inflation is accounted for.

“Using projected inflation rates for the third quarter of 2024, we calculated the ex-ante real interest rates of mortgage loans in 62 countries around the world.

“When the effect of inflation is removed, countries such as Sweden, Switzerland, and Spain end up with negative mortgage interest rates.

“Hyperinflation, however, leads to even more abnormal results, with Turkey now having a negative interest rate for mortgages of -10.84 per cent, while the triple-digit annual inflation in Argentina has caused real mortgage interest of -175.89 per cent.”

Australia’s nominal fixed interest rate is 6.28 per cent but as a real mortgage interest rate it stands at 3.48 per cent.

Despite the relatively rosy picture painted of Australia’s property market from a global perspective, many Australians will take cold comfort from a worsening situation.

Just 28 per cent of Australians are optimistic about their financial outlook for 2025, as rising living costs continue to strain household budgets, according to a recent Canstar report.

Cost of housing is Australians’ top concern in 2025, closely followed by food costs.

The outlook doesn’t look any better when the majority of Australians anticipate house price growth through to 2026. The recently released API Magazine Property Sentiment Report Q4 2024 found that 69 per cent of respondents expect property price growth over the coming year.

If there was a ray of sunshine for prospective buyers, more Australians this year feel confident the RBA and the government can ease inflationary pressures and reduce the cost of living in 2025.

And there’s always this world map to look at for some cheering up if you’re in Australia, where those 147 pay packets look like a reasonable deal compared to most places.

Article Q&A

Which country has the most affordable property?

South Africans enjoyed the most affordable property, requiring just 71 net monthly wage payments to buy a home. Rounding out the top 10 were the US (76 monthly salaries), Bahrain (99), Denmark (114), Ireland (123), Sweden (129), Spain and Belgium (132), Cyprus (139) and Norway (140). New Zealand was 11th and Australia 12th.

Which country has the least affordable property?

At the most expensive end of the spectrum was Nepal, where high property prices and low incomes meant it required a debilitating 684 (or 57 years’ worth) of monthly salaries to buy the average home. Turkey (631), India (578) and Indonesia (563) offered almost as little hope to home buyers.